Previous

Next

( A Unit of JK Group )

Scan To Pay

Online Courses

Business Accounting

This Course is the first step towards learning of Professional Accounting. Start Converting your bookish knowledge into practical. This course contains very useful information regarding the practical accounting work of Trading, Manufacturing and Service Industry.

The course is very useful to all fresher B.Com, M.com, MBA, CA, ICWA, CS and all others who wish to work as a professional accountant in any type of Industry. The course is also very useful for those who has 3-4 year of experience in accounting field. Start learning accounts works with this course now.

Accounts Expert

Our Accounts Expert course is based on 100% practical work. Learn Manual and Computerized Accounts from basic to finalization of Balance Sheet in few days. The course is very useful for Professional Accountants who wish to work at very good position in any type of Industry.

Along with online video classes, Study Material and Practice Projects also provided to enrolled students. Our Practice which are based on actual business transactions. Through our online training any one can learn professional accounting very easily even you don't have any accounting background.

Taxation Expert

Learn complete Indian Taxation from Basics to filing of online Returns. Our Taxation Expert course provides complete knowledge of Direct and Indirect Tax including GST. The course is based on 100% practical work through project work. This course is very usefull if students have some experience in Business Accounting; otherwise it is recomended to complete our Course-1 and 2 before starting this course.

Practice Projects provided to enrolled students, which is based on actual business transactions. Indian taxation explained in a very easy way, anyone can understand in very short duration with perfection.

Accounts & Tax Expert

Our Accounts and Tax Expert course is the combination of Course-1, Course-2 and Course-3. This course includes all contents of our Business Accounting, Accounts Expert and Tax Expert Course. This course is a stunning course for Fresher B.Com, M.Com, MBA, CA, ICWA, CS, Business Men and also who wish to work as good accounts professional.

Our Accounting and Taxation Course provide complete practical knowledge from basic to finalization of Balance Sheet and filing of online returns. After successfully completion of the course every candidate can works as a five to seven year experience person.

Short Courses

GST

GST was introduced in India on 1st July 2017. Basically Goods and Services Tax is in the replacement of 17 Indirect Taxes, mainly VAT, CST, Service Tax, Excise and Entry Tax. Our Institute providing complete training of Goods and servies Tax (GST) from Beginner to Expert level. We are providing GST training form Basics to filing on online terurns through online portal. Along with online classes we are also providing Practice projects and Study Material.

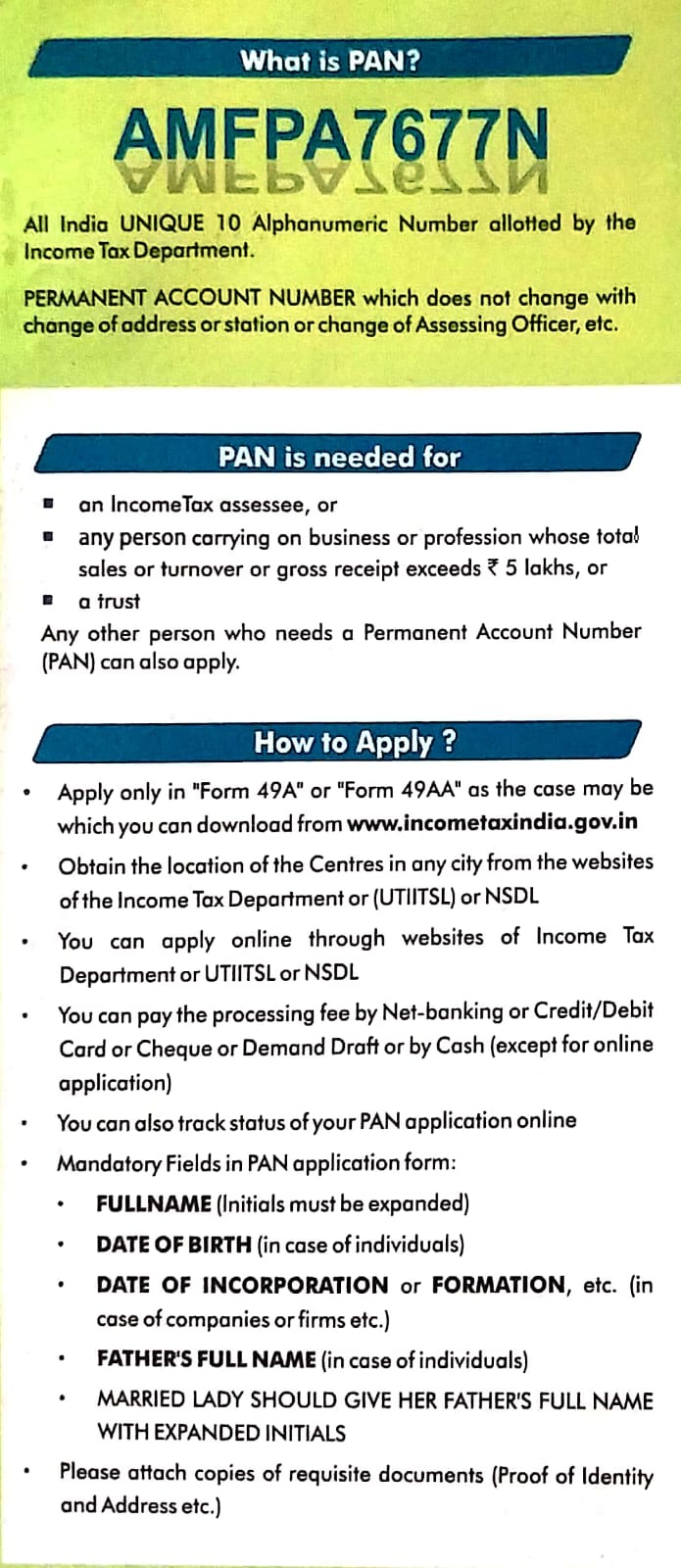

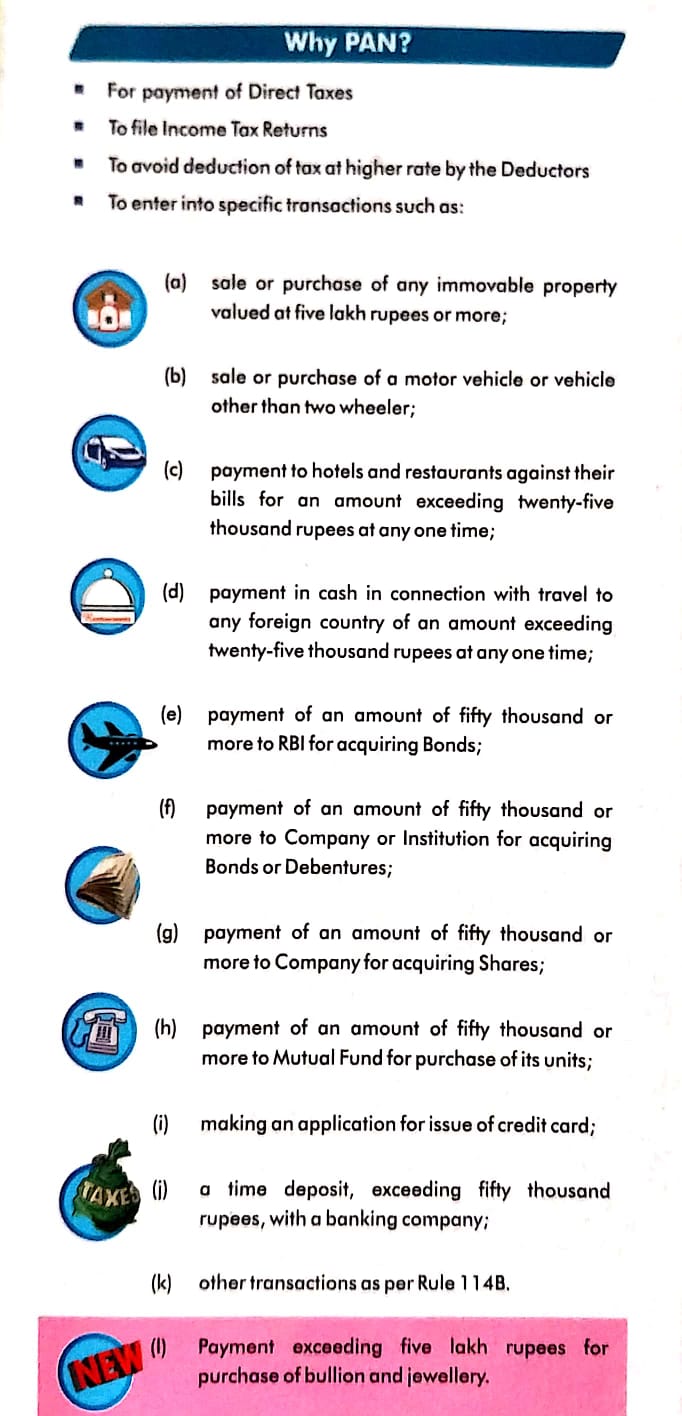

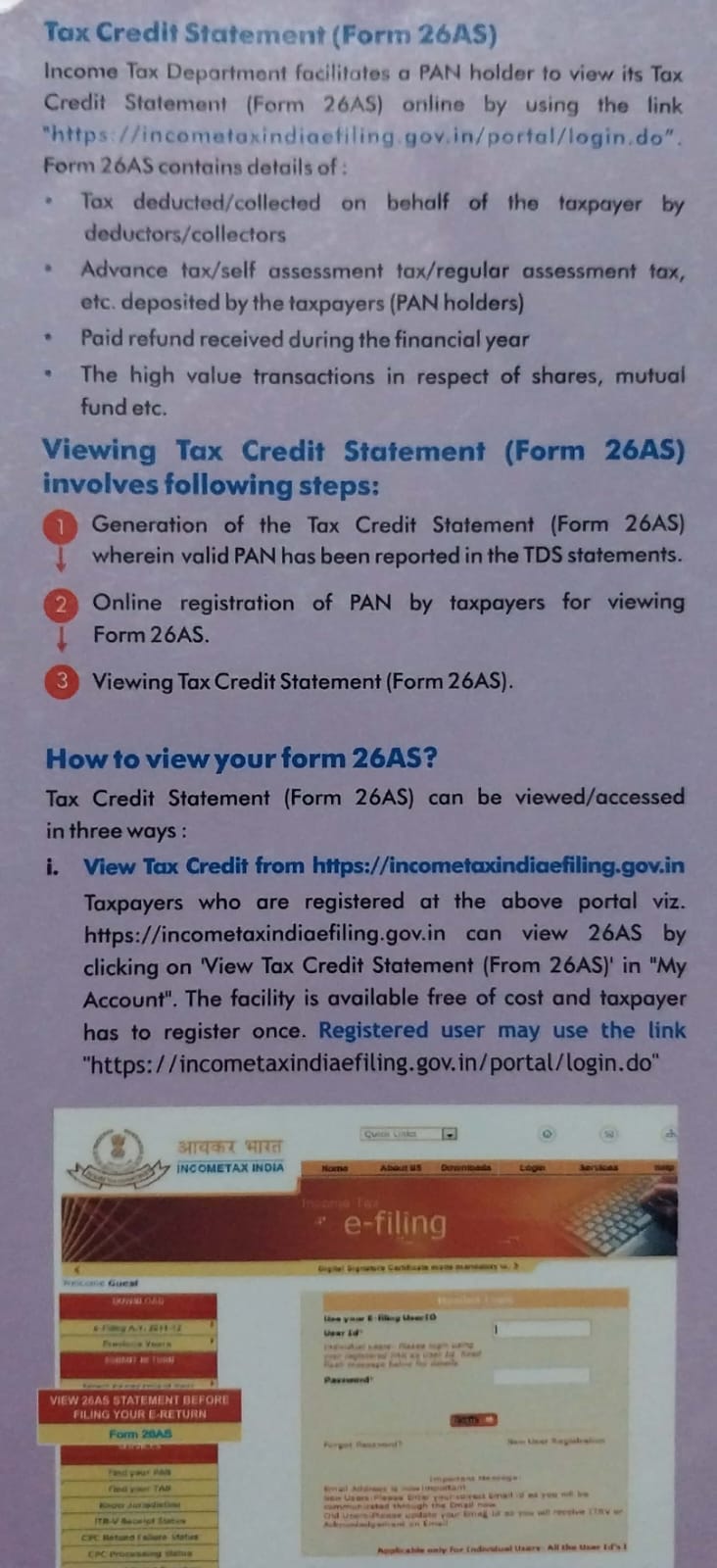

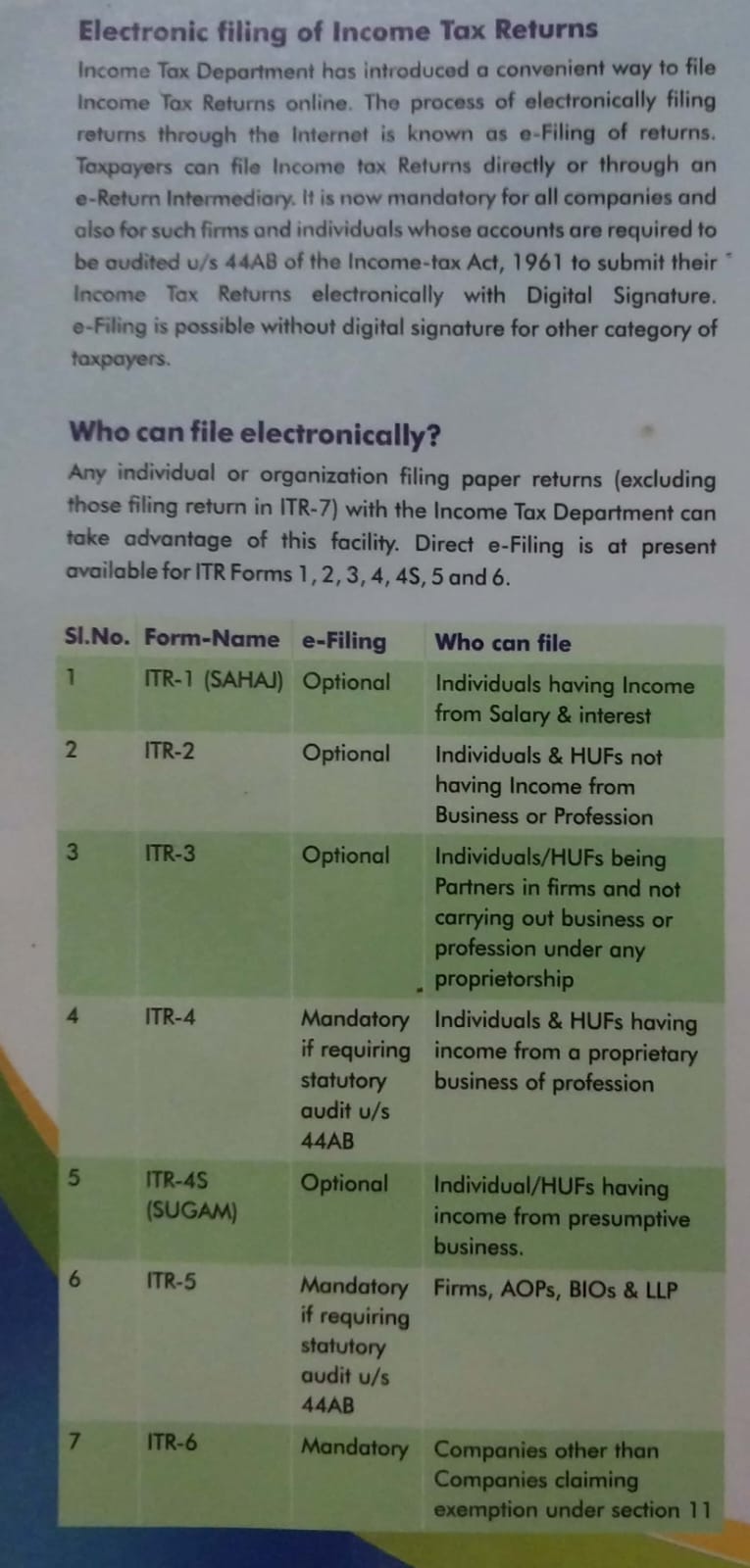

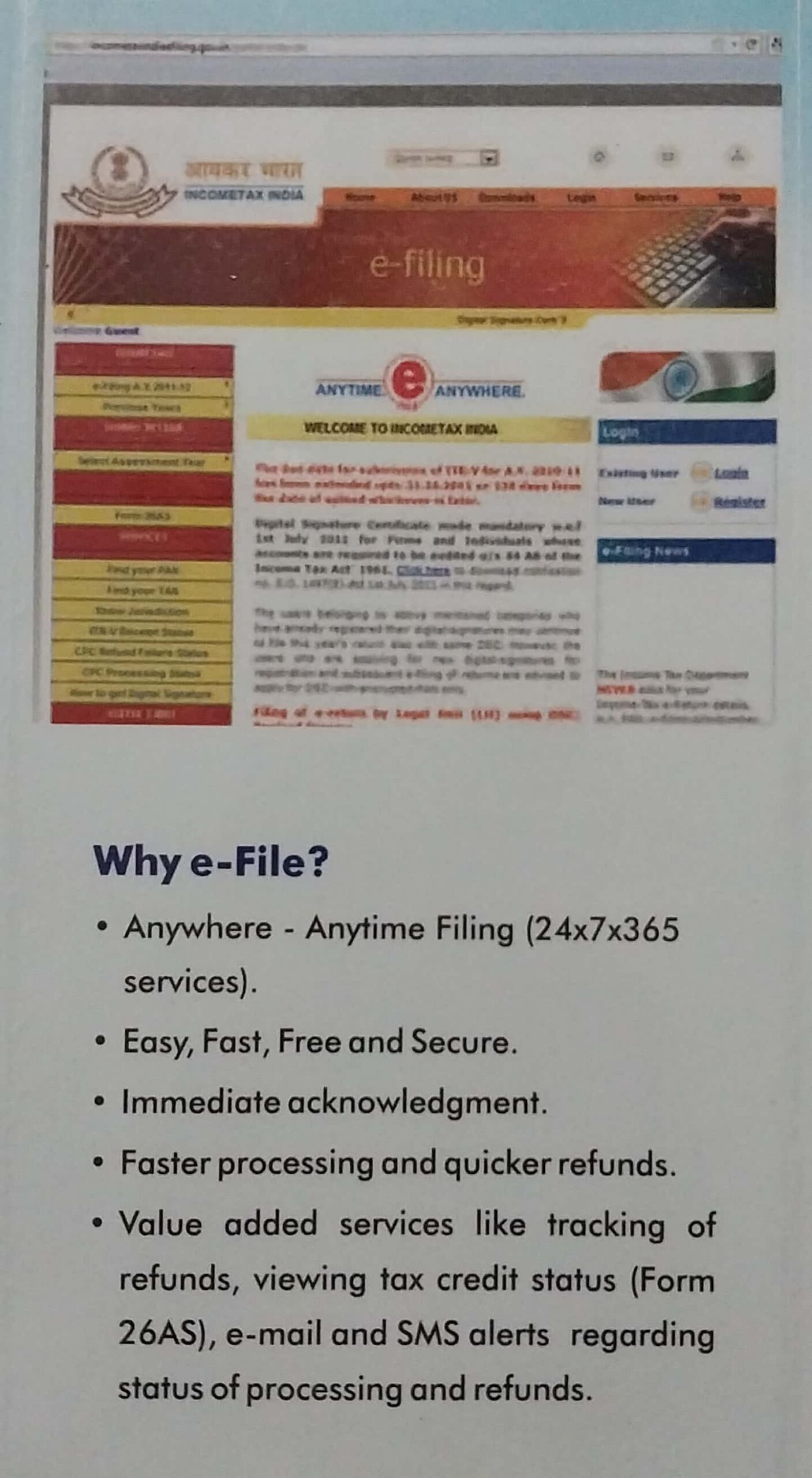

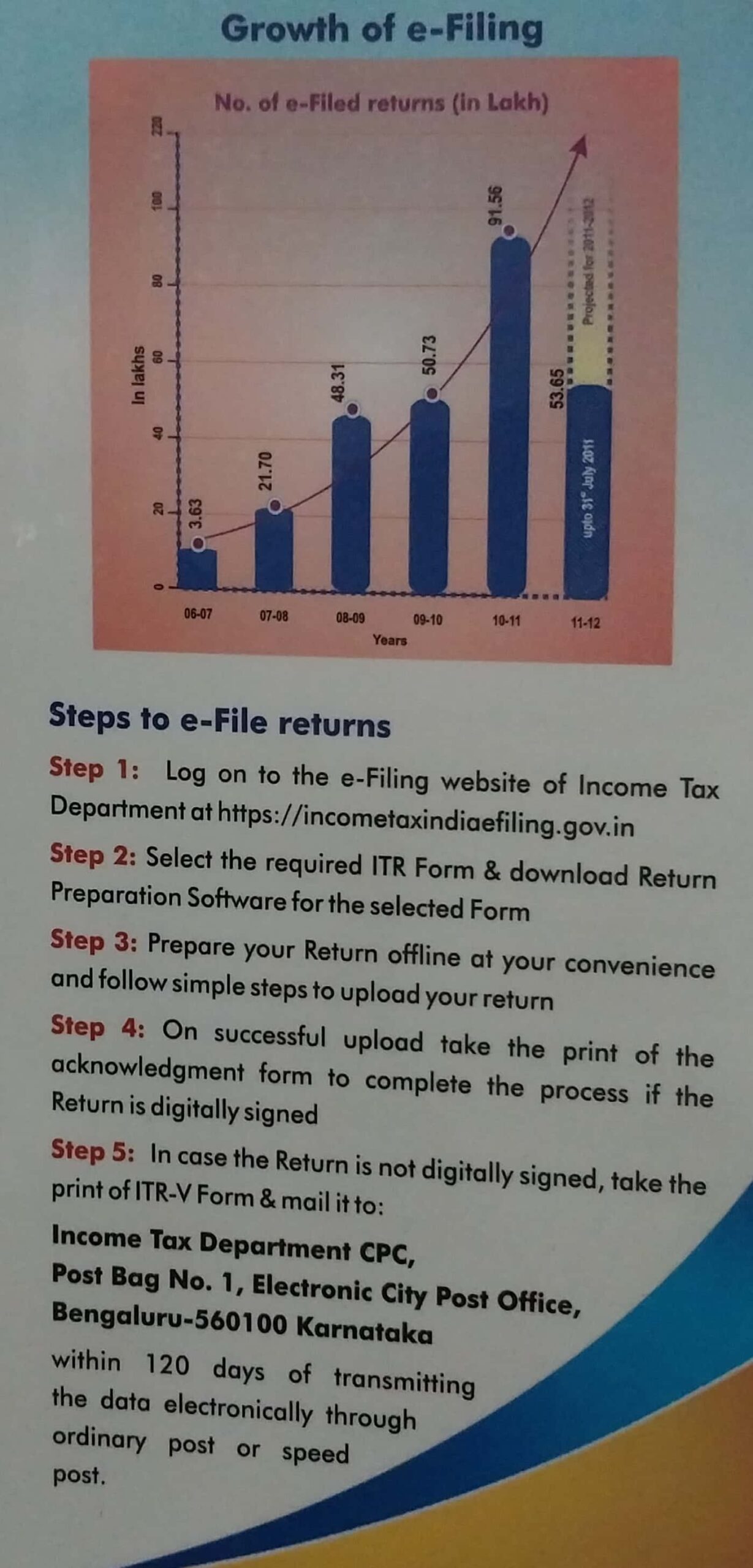

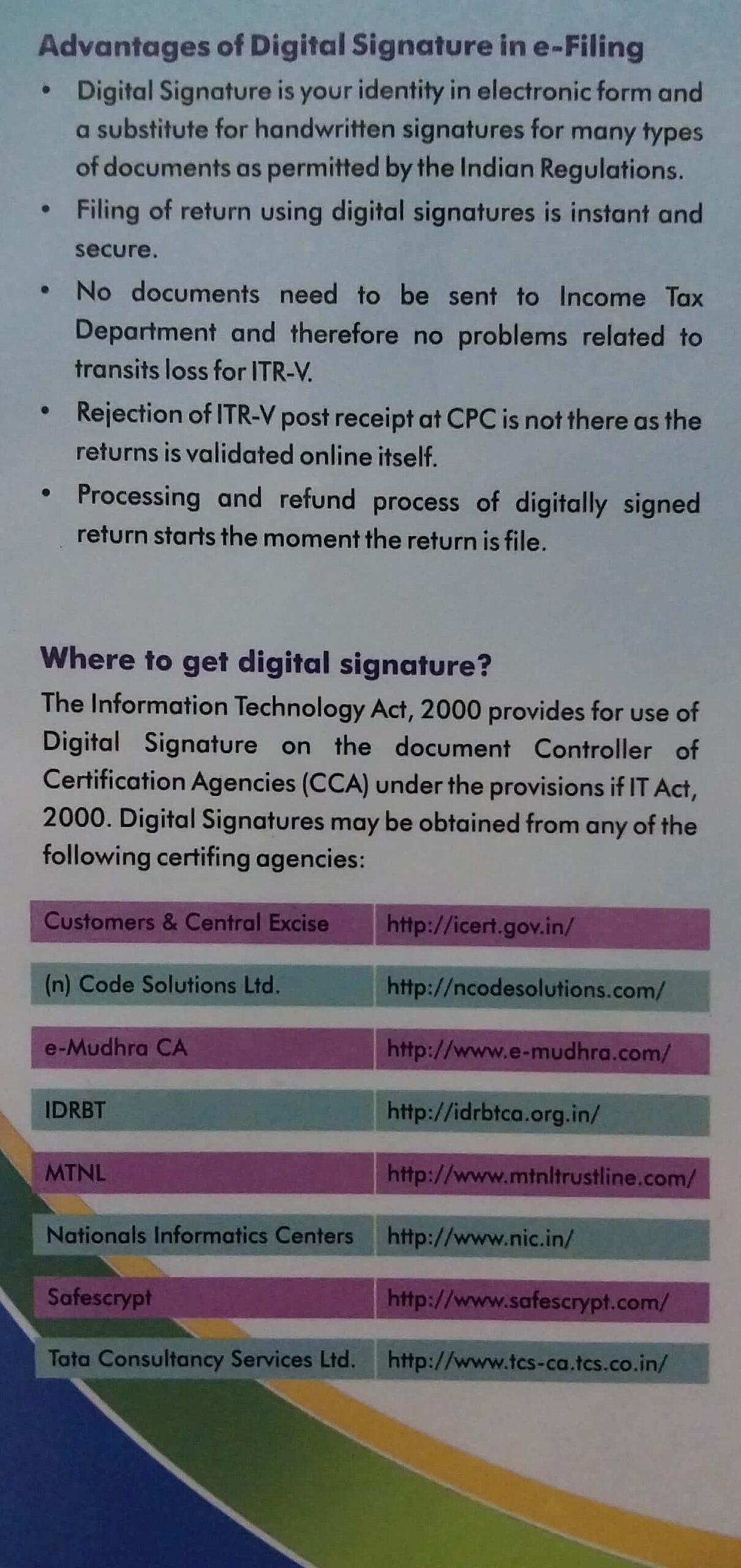

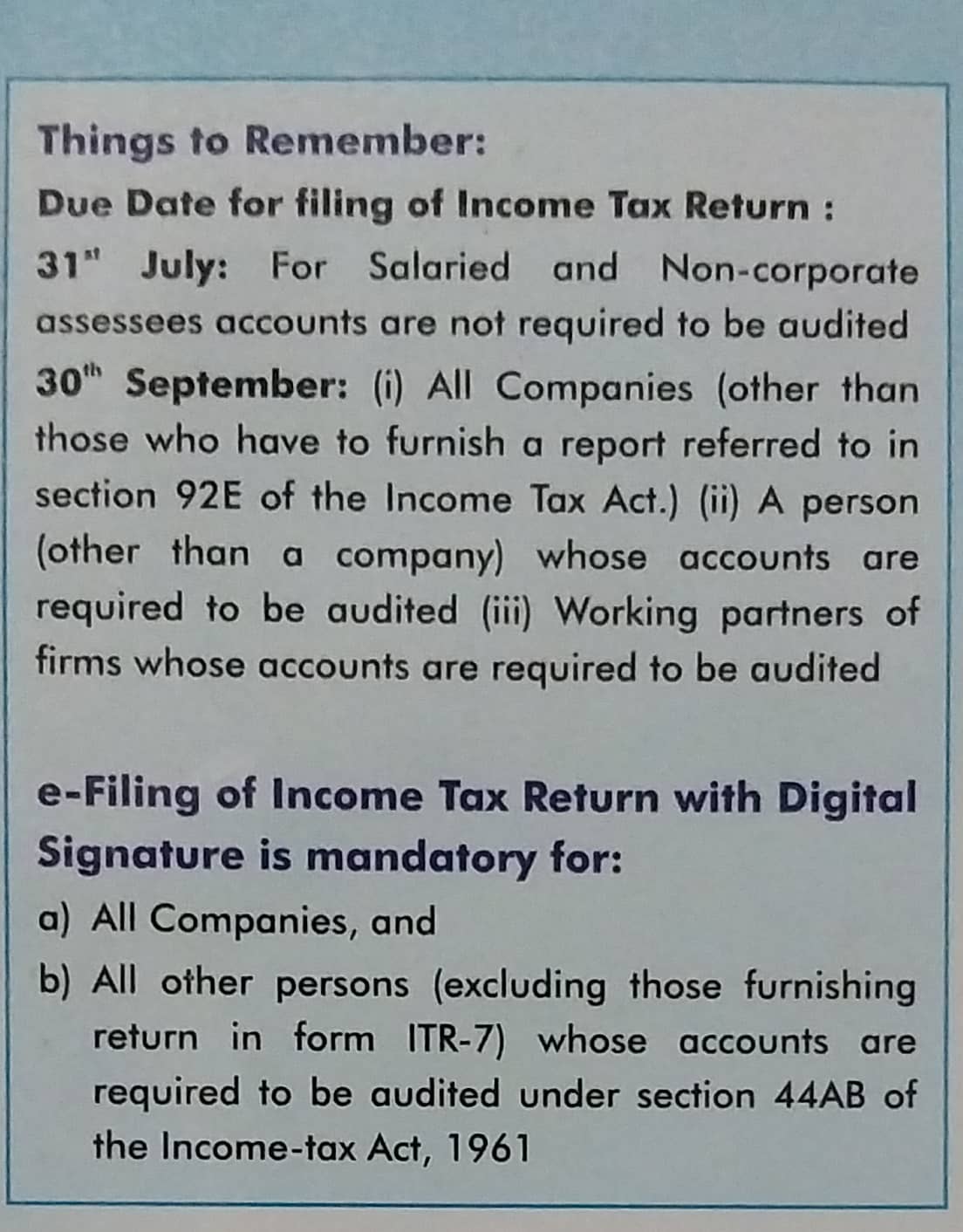

Income Tax

This Course includes complete concept for calculation of Income Tax of an Individual with all types of Incomes like, Income from Salary, Income from House Property, Income From Business and profession, Income From Capital Gain, Income from Other sources, This course includes all contents from basics to filing of online returns.

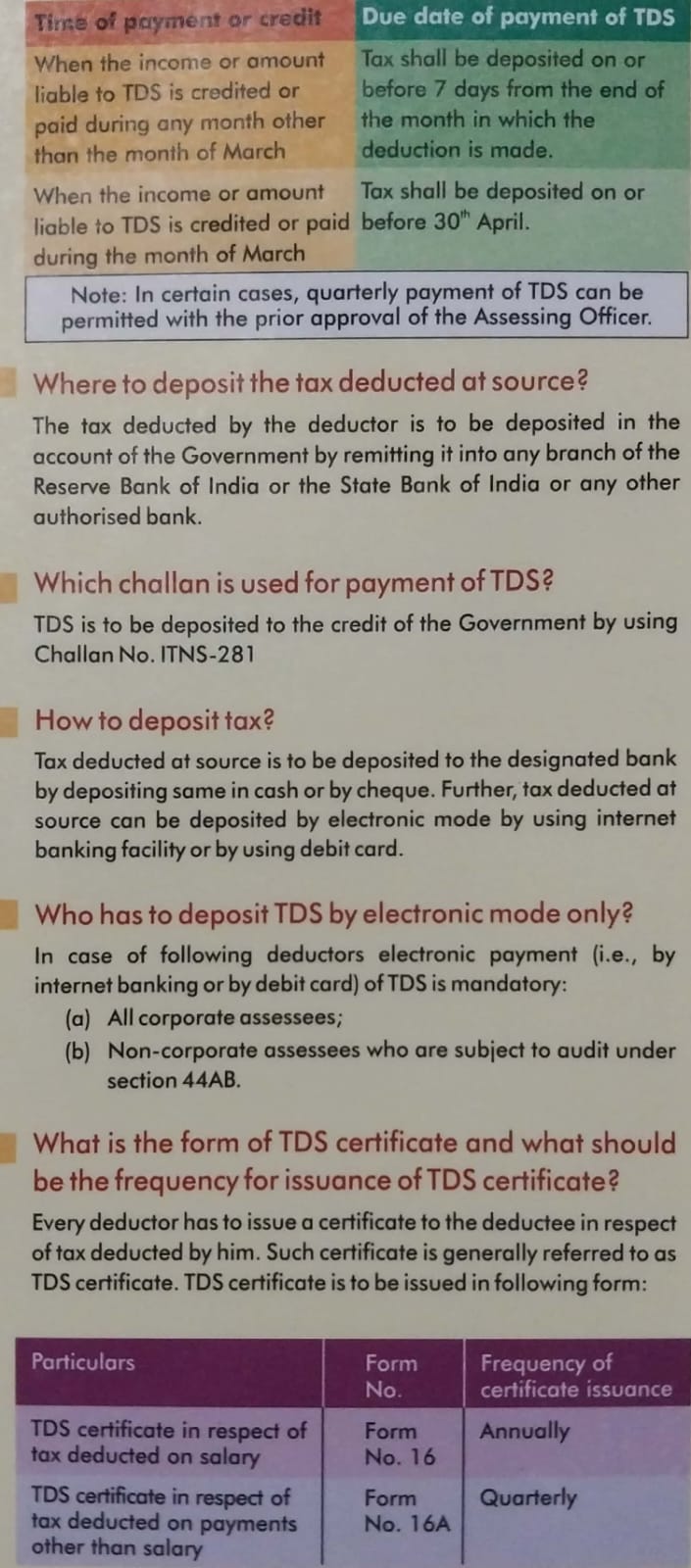

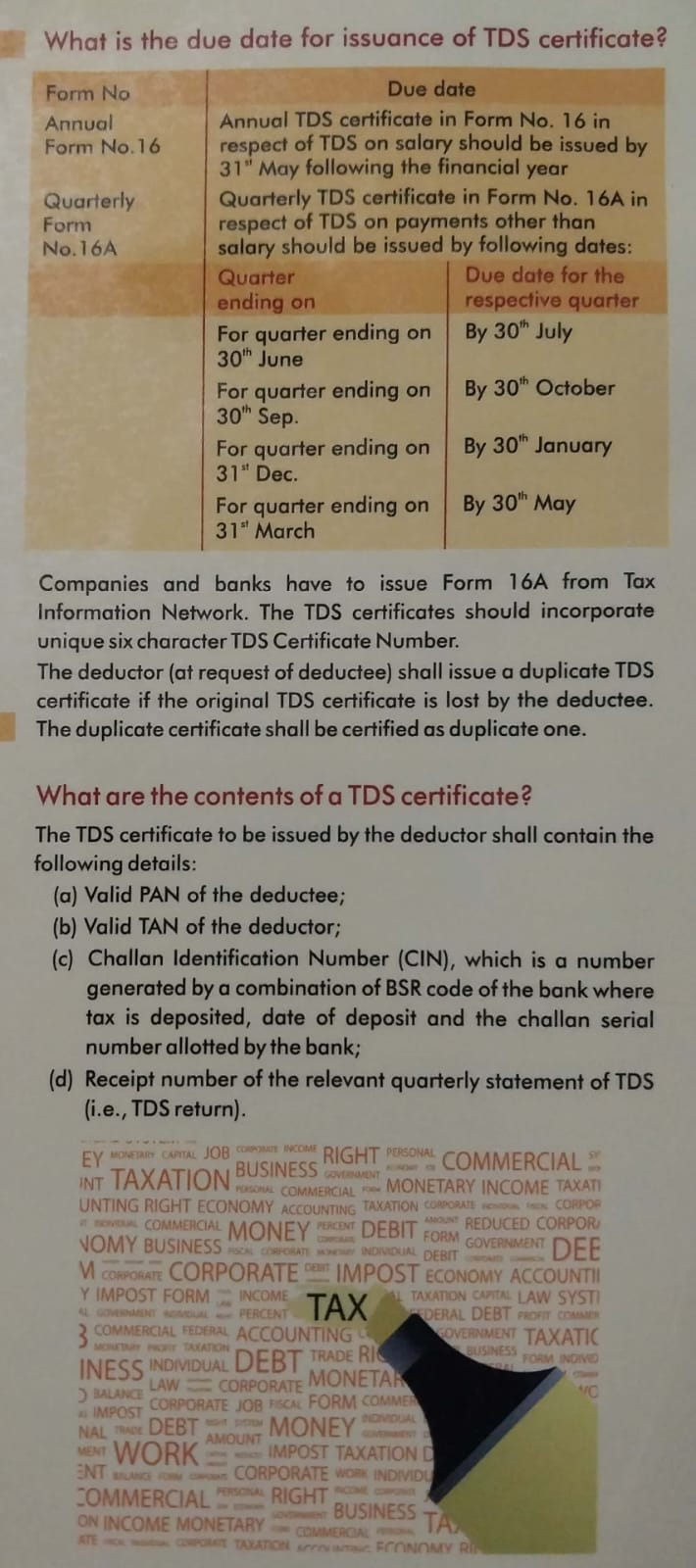

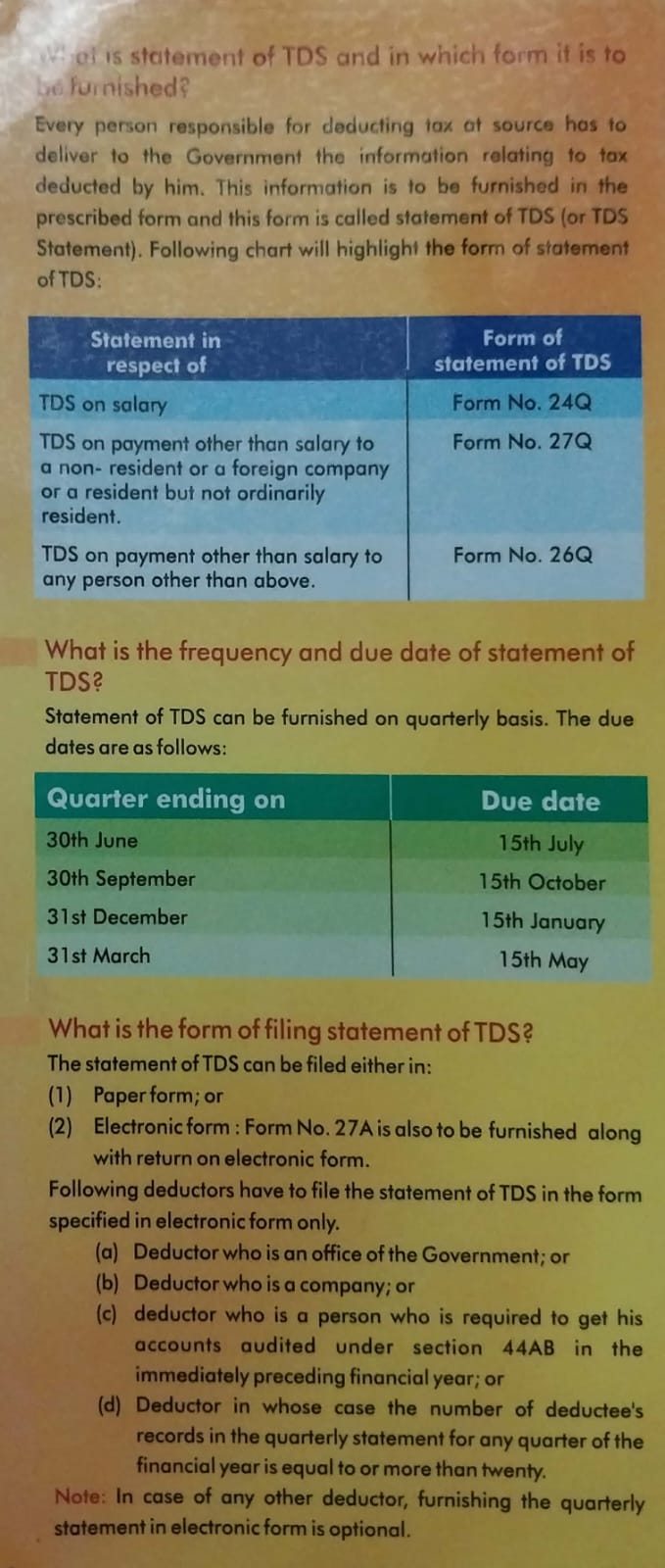

TDS

Tax deduction and collection at source is the very important part of Income Tax. Every Accountant should have knowledge of TDS and TCS practical work. Basically this is a system introduced by Income Tax Department, where person responsible for making specified payments such as professional fees, commission, works contract, advertisement, interest, rent, salary, etc. is liable to deduct a certain percentage of tax before making payment.

In this course we have covered all the aspects of practical work as required for practical work. All the contents of this course are also a part of our Tax Expert Course. If you want to learn only TDS/TCS work you can enroll in this course.

Tally

The Tally is the most popular accounting software in India. Millions of business organizations are using Tally Erp 9 accounting software. Tally software provides complete solution of Accounting, Inventory, GST, BalanceSheet, Reconciliations, and payrolls. Tally.erp9 accounting software provide solution of almost all Indian Taxation.

In this Tally course our institute is providing complete training in Tally.erp9 Software with project work. This course is recommended only if student have knowledge of practical accounting/ Journal Entries also the concept of Inventory and taxation. For all fresher students we recommend our Accounts and Taxation Expert Course. All the contents of this course are also a part of our Accounts Expert Course.

Balance Sheet

Without the knowledge of balance sheet no one can work as a professional Accountant. Even no one can pass a basic journal entry of any business transaction without understand the balance sheet. Basically we need to follow the work culture of every business organization and balance sheet is the main source of understanding the work culture.

In this course we have covered all the aspects of balance sheet form opening balance to finalization. Along with video classes, a practice project of "M/s Hindustan Construction Co" has also provided. You will learn while doing practical work through our practice project.

Join Institute of Taxation

For Daily Update just ₹730 per annum OR ₹2 per day related to GST OR INCOME TAX through WhatsApp OR E-Mail

Previous

Next

IOT Team trained more than 15000 people to Any Graduate, Chartered Accountant, Cost Accountant, Company Secretary, MBA's , Surveyors and Others